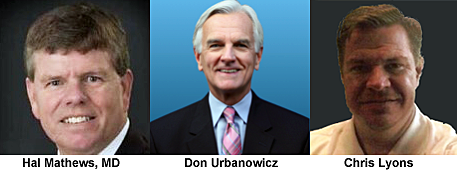

Interview with Hal Mathews, MD of Paradigm Spine, Chris Lyons of Medtronic Spine & Biologics and Don Urbanowicz of Urbanowicz Consulting.

On October 25, 2016, Capital One, BioMedGPS and Kinsella Group sponsored a panel discussion prior to NASS 2016. Multiple panel members participated in the event which covered a variety of topics. The discussion featured in the excerpt below focuses on “Insights And Perspective: Medtronic and Paradigm Spine” with Hal Mathews, M.D., MBA – Executive Vice President and Chief Medical Officer for Paradigm Spine, Chris Lyons – Director of Global Business Development for Medtronic Spine & Biologics and Don Urbanowicz of Urbanowicz Consulting.

Don Urbanowicz: Well, thank you, and welcome everyone to Boston, for our fourth annual pre-NASS Reception. Let’s start the discussion with Chris. By my count, Medtronic Corporation, since January of 2015, concluded about 14 transactions in total but yet only two were in orthopedics, including an equity investment in Mazor. Should that surprise us?Chris Lyons: No. Here’s the rationale as to what’s going on behind the scenes. We are trying to be very deliberate about what we are focusing on. It’s very easy to try and be everything to everyone, and I would say that Medtronic is one of those companies that for a long time has been, let’s do this, let’s do that, let’s do the other. Specifically, in spine, we’re trying to do things that are smart bets. Everything that our CEO is basically leading has been about making smart bets and I would say the bar has essentially been raised. The growth of out-patient procedures especially is a big trend that we’re continuing to watch closely and we actually have a vested interest in going after. It is going to come on the heels of what’s happening with robotics.

"The growth of out-patient procedures especially is a big trend that we’re continuing to watch closely and we actually have a vested interest in going after." -Chris Lyons

Don: Chris, two follow up questions. The first: Your CEO was intrigued enough to invest in Mazor, so give us the strategy behind that and tell us why it was a smart bet, and secondly, tell us why you acquired a low cost orthopedic hip and knee implant company?

Chris: So strategically, what I can share is that from the Mazor standpoint, we see this as a technology that, if not the best, it’s one of the best. The advent of robotics in spine procedures and orthopedic procedures in general is upon us and we want to be on the front end of that. There were key things about Mazor that made sense to us in terms of it’s placeability, not only in the traditional hospital O.R., but also in the ASC, and so there are elements to this to where you need to figure out how to make these things play across the board, especially with the big shift that’s coming from an ASC perspective. I think that you’re going to see that even though you’ve got high capital operations in robotics, there are so many different models we can put together that are subscription-based models that make sense for everyone, regardless of the value or the money that any of these institutions has.

"The focus is, how can we drive the cost of goods down to such a level to where you’re able to offer a knee at a substantially reduced ASP?" -Chris Lyons

As it relates to the ortho piece, we did step into the hip and knee arena to take advantage of the value based healthcare platform. There is a substantial platform that is coming with this. Yes, on the outside, you see a hip and you see a knee – and that’s Responsive Orthopedics. The focus is, how can we drive the cost of goods down to such a level to where you’re able to offer a knee at a substantially reduced ASP? It’s hard to undo that for a lot of the existing orthopedic companies when what they’ve been used to has been a premium relative to the cost of goods, but Medtronic came in knowing the answers to the test, it helps out a lot in terms of your position.Basically getting in the door, and then bringing the rest of your value add along with it. And that’s exactly what we’re doing.

Don: Thanks. Hal, tell us about Paradigm’s evolution. If you and Marc Viscogliosi had to start Paradigm over, would you do anything differently?

Hal: Paradigm got its PMA approval four years ago this week, so recall six years of protocol development, running a post market approval study and then successfully obtaining PMA approval creates a long cycle for any new technology to come on board. It’s about ten years for the process from start to finish and then a commercialization process can gain traction. Paradigm is this precious gem of a company that has the only product in a category that defines a patient group of about 300,000 patients a year undergoing spinal surgery for lumbar spinal stenosis, that offers a new method of stabilization after decompression in an outpatient setting that has never happened before. As spine moves to outpatient surgery, the codes for inpatient have been modified over the last year, the codes for outpatient ambulatory and ASC are modified right now under the payment rule of 2017, and the CPT codes for physicians using interlaminar stabilization go into effect January 1, 2017. With safety and effectiveness being established in the PMA, the safety, quality, and cost savings of the ASC environment offer options for patients and physicians to offer the best site of service to fulfill a patient’s choice and medical needs. Marc Viscogliosi and his team get a lot of credit for delivering a world class PMA with 95% follow up and the five year published evidence in early 2016. There are additional studies underway at Paradigm Spine, including another level 1 study with simple decompression as a control, a massive multistate effort to collect approximately 3000 patient retrospective surgical data, and a prospective observational study called coflex Community Study that analyzes real world community use of interlaminar technology. Data helps drive surgeon and patient adoption and drives payer decisions for coverage. The CMS payment rule of 2017 helps to define the safety and effectiveness decisions that now allow interlaminar stabilization to be performed in an ASC setting.

"Data helps drive surgeon and patient adoption and drives payer decisions for coverage. " -Hal Matthews, MD

Don: So Hal, with coflex, reflect back and tell us what went particularly well, and what you could have done better with the product?

Hal: The team executed flawlessly on the PMA. That is so hard to do right now, because PMA’s are really expensive and difficult to obtain. Most PMA’s do not get approved and Paradigm’s clinical and regulatory team performed very well. If you were to look at anything that we could have done better, I would have to say Paradigm, and other companies with new technologies and PMAs, underestimated the rules for coverage decisions by private payers. All payers are different and do not follow established rules of evidence based medicine and will not disclose the hurdles for coverage decisions. Hence, physicians and patients are often misdirected when trying to obtain appropriate access of new proven technology. Now imagine total disc in 2006. coflex is now four years into a total disc project, just the same as what Spine Solutions was with ProDisc and DePuy with Charite and remember the frustrations surgeons and patients experienced 10 years ago. If anything has changed, this process has gotten more difficult and costly to all stakeholders in healthcare. Payer reform through congressional oversight is needed in this process.

Don: OK, thanks. Chris, we have many CEOs of OEM’s in the audience, entrepreneurs who say, it’s so hard to navigate through one of the big strategics, or it takes forever to get a deal done with one of the big companies. What are you doing, as the head of BD at Medtronic Spine, to make that process more efficient and transparent to small company CEO’s?

"The thing I’ll stresses is this; . . . as companies come to the big strategics to look for opportunity to partner, whatever that partnership may look like, the key thing is have everything as buttoned up as you can. " -Chris Lyons

Chris: So some of you in this room have been subjected to the process. Let me be clear, when I go back and I think about 2008, there was no process. One of the big focuses that we had was to put a process in place that would make sure we were just not checking boxes, but that we were making the industry better by this process. Here’s what I mean by that. There’s not a single company that I can tell you that if they had gone through a process with Medtronic Spine whether it be executing a distribution relationship, a minority investment relationship, a license or an acquisition, that they weren’t better off because of the opportunity to do that with us. The reason is, we know how important quality is. To Hal’s point as it relates to Paradigm and coflex, the amount of time, I guarantee, that these guys have had to spend with the reimbursement experts has been probably on par to what they’ve had to spend with the FDA. Eight years ago, that was not the case. And so, there are things that as we’re seeing the winds of change, we need to be able to pass that information on, especially to the smart organizations. So when we look at it, we’re asking, how do we improve our process to get from A to Z that much faster? One of the big things is the decision. Close the deal. We’re in a matrix organization. But there is a pathway, and it’s this entire weave that we have to do to get there. The thing I’ll stresses is this; for anybody, whether you are a supplier, whether you’re a startup, or whether you’re an investor, as companies come to the big strategics to look for opportunity to partner, whatever that partnership may look like, the key thing is have everything as buttoned up as you can. So that once we sit down, we can help take you to the finish line. We may consummate a deal and that’s great for everybody. We may not consummate a deal. But if you learn something in the process, you win as well, and we do too, because we are improving as we’re going. Our CEO is very critical about making sure that we’re being good industry citizens to how we manage our relationships with companies. And I’ll be the first to say that from a spine and biologics standpoint, we take relationships seriously.

Don: Chris, I always get asked, what is the typical transaction time frame that a privately-held company should expect from a big OEM like Medtronic Spine, from the start of due diligence until closing?

Chris: Can I ask a question off that question? What do you think should take longer, an acquisition or a distribution relationship? Well it actually takes less time for Medtronic to do an acquisition because we work out all the bugs in integration. The distribution relationship actually takes longer because the company has to be “Medtronic-ized” before we actually sign the deal. So you go through CAPA correction, and you go through these many things that are necessary to make sure that the product is what it needs to be, even if it’s just our name down on the corner of the package that says distributed by Medtronic. And so, I would say that a typical distribution deal scenario is a nine-month process. In an acquisition scenario, it could be 3 to 6 months. It depends on the fervor of what you’re bringing to the table, the relevance of the product, and the fit for us as to how fast were going to move. As it relates to Mazor, to get that deal done, we had a visit to Israel right before Christmas. We had five turns of the term sheet by the end of January, and so it was rapid.

Don: Good, thanks. We’re going to go with one more round of questions. So Hal, I’ll put myself in the shoes of the CEOs and entrepreneurs in the audience. Many struggle to raise $2 or $3 million dollars. Paradigm has raised in excess of $200 million dollars, so why have you done it, and how is Paradigm looking to invest that money?

"It’s an easy mistake to undercapitalize a small startup, and not have the capital to build out and to develop the infrastructure for reimbursement and payer dynamics. " -Hal Mathews, MD

Hal: I should state the amount is probably a little less than that, and certainly we haven’t spent that much to date. Fortunately, we have a long runway and expect great results from our commercialization efforts and fortunately we are well capitalized. It’s an easy mistake to undercapitalize a small startup, and not have the capital to build out and to develop the infrastructure for reimbursement and payer dynamics. This is something that the Paradigm team has learned about being well-funded, and is clearly a good thing for Paradigm because we have the balance sheet and we can really do what we need to do to drive interlaminar stabilization as a new standard of care.

Don: Thank you. So final question. Hal, does anything keep you up at night as it relates to the spine business? Is there anything that you worry about?

Hal: Actually, I don’t worry about anything that we control. We can’t control everything that’s going to affect us including the lack of disclosure from payers for universal coverage. We are constantly focusing and redefining our efforts to improve access for the technology. This is priority number one for Paradigm Spine. The safety and effectiveness of the technology in level 1, 2, and 3 studies is well established in published literature. There are over 70 publications in world wide literature about coflex and interlaminar stabilization. We try to position the company strategically, with well-funded assets, and excellent clinical studies and five-year published data, and multiple layers of research and education to validate the technology. Using retrospective study data from many clinical sites in multiple states we can create tremendous awareness of the unmet clinical need for patients and payers. In Florida, for example, with more than 3000 surgeries already performed, our post approval community use of interlaminar stabilization with coflex showed better clinical results than the US 5 year PMA study regarding the need for costly additional intervention and treatments. This is great news for patients and payers. In post approval community use it’s important to prove safety and appropriate adoption by surgeons and patients for any new technology. I think we have proven this in multiple ways. So, in reality, I lay in bed at night thinking about the next day enjoying what I’m doing and how I can be more impactful tomorrow and the next week -- not what fears are out there and what we can’t control. So I am in a good place and it’s a good situation.

Don: Thank you. So, Chris, final question and then we can open it up to the audience. Tell us about the trends that Medtronic Spine is seeing that will impact the market five years ahead?

"For a long time we’ve been reacting to what’s happening with reimbursement. There’s got to come a point in time to where we are actually influencing it. " -Chris Lyons

Chris: Absolutely. So, it’s stepping outside the procedure in many, many ways. You hear us talk about the fact that it’s no longer about the widget, and it’s not. Yes, that may be the end game, but how are you going to get the patient there? How are you going to follow him from the beginning of the continuum of care, all the way through the post-op management? And so the strategy that we’re putting in place is just that. It is a complete wraparound approach. I remember six years ago, putting as part of my strategy from a BD standpoint, I really want to get into diagnostics. And everybody’s like, what? Guess what? It will become primo to the future of spine practice as those companies that come along and figure out how to properly diagnose what is going on in the spine. We are paying a lot of attention in this area. And so the reality is, how can we, as industry, work together to meet the patient at their earliest point on the continuum? What’s the next thing that’s going to compete most effectively with epidural steroid injections? What’s the thing that we can do to prevent opioid usage? What’s the next thing that actually diagnoses when a patient’s ready for surgery or not, and therefore the insurance company’s going to love you because you can tell them that. What’s the next thing that then gets them into the best implant that they can utilize? Whether it’s a coflex or whether it’s another type of implant. And then how are you going to follow them up to go back to the insurance companies with your message to say I told you so? We need to become more bullish about how we manage these things from a manufacturer’s standpoint. And to say look, for a long time we’ve been reacting to what’s happening with reimbursement. There’s got to come a point in time to where we are actually influencing it. And that’s what were focused on.

Don: Very good. Everyone has been standing for some time, so please, is there a question from the audience?

Question from the Audience: With the current election process that we’re in, we’re about to elect a president for the next four years, and the way the current trend is, we’re going to continue to have another eight years of health care reform, based on what we’ve seen. What are you doing as an industry with organizations to combat the level of reimbursement and the level of evidence, specifically for reimbursement with new technology as well as nonfusion technology?

"When the surgeons and the patients figure out that they’re being denied access to care and the surgeons are willing to advocate for technology, payers will start to listen. Evidence doesn’t drive this process scientifically as patient demand seems to be what payers are listening to. " -Hal Mathews, MD

Hal: We live that in Paradigm Spine every day. coflex is a non-fusion stabilization device, to be implanted after decompression for spinal stenosis. So, we’re unimpressed at how payers like five-year data. We have five-year data published with over 90% follow up at five years, better long-term data than anything in spine and payers want to see seven year data. We’re collecting that also and you can see how the process drags out and becomes increasingly costly even after proven PMA safety and effectiveness. But we learned something recently that when the surgeons and the patients figure out that they’re being denied access to care and the surgeons are willing to advocate for technology, payers will start to listen. Evidence doesn’t drive this process scientifically as patient demand seems to be what payers are listening to. We’re seeing a lot of interest in payers that are actually coming to us and asking us questions about the technology, rather than us trying to force it on them, but it doesn’t have to be this hard, and Chris, to your point, we should be working together to try to establish standards and society guidelines that educate payers to what’s important for the patient. ISASS has just published coverage guidelines for interlaminar stabilization and NASS is currently in their process to publish their recommendations soon. All those things are in place to help, but it’s way too expensive and labor intensive and it should not be this difficult.

Don: I’d like to thank our panelists and audience participants. We hope to see many of you again at our pre-AAOS reception tentatively scheduled for Tuesday evening, March 14th, in San Diego.