.png?width=711&name=Nov%202019%20-%203M_Acelity_%20A%20Deeper%20Look%20(1).png) SmartTRAK examines what the combined company will look like in terms of revenue, product portfolios, financial performance and more.

SmartTRAK examines what the combined company will look like in terms of revenue, product portfolios, financial performance and more.

In its biggest deal to date, 3M recently announced the acquisition of wound care giant Acelity and its KCI subsidiaries for $6.7B, a move that propels 3M to the top of the Advanced Wound Care (AWC) market when the deal closes in H219. Although 3M is known more for Scotch Tape than for its wound care products, the Company’s Medical Solutions Division markets a variety of products for skin care and wound healing and currently holds ~2% share of the AWC market according to SmartTRAK Financial Dashboard. By acquiring Acelity/KCI, the global leader in the WW AWC market with 21.7% share in 2018, 3M will become the largest AWC supplier in the world, with a combined share of 23.7% according to SmartTRAK estimates. The next closest competitor is Smith & Nephew (S&N), with ~15.8% WW share in 2018.

So what will the combined company look like in terms of revenue, product portfolios, and financial performance? What are the potential synergies and risks? How does it compare to other deals in the advanced wound care space? What lies ahead as they integrate the two companies? SmartTRAK looks at these questions and more in a review of the businesses and an analysis of the deal.

REVENUES

As of Q119, 3M’s Health Care business accounted for approximately 20% of the Company’s total revenue. The segments that make up 3M’s health care portfolio include Medical Solutions, Oral Care, Separation and Purification, Health Information Systems, Drug Delivery and Food Safety. The Medical Solutions division is responsible for a significant portion of 3Ms Health Care revenue, accounting for approximately 50% of the total.

The Acelity/KCI product portfolio is primarily made up of NPWT, Advanced Wound Dressings (AWD) and Specialty Surgical products. According to SmartTRAK’s Q418/FY18 AWC market analysis, NPWT accounted for 79% or $1.2B of KCI’s Advanced Wound Therapeutics (AWT) revenue, with AWD making up 12% and Specialty Surgical products accounting for the remaining 9%.

PRODUCT PORTFOLIOS

3M’s Medical Solutions portfolio contains its AWC products and brands, which according to 3M are categorized into three segments: Prevent, Prepare, and Secure & Protect. The Prevent segment includes the Cavilon brand and focuses on skin protection and management. The Prepare segment encompasses the Tegaderm brand and includes antimicrobial dressings, cleansers and debridement products. Lastly, the Secure and Protect segment includes the Coban 2 and Steri-Strip brands and offers advanced wound dressings, compression and closure solutions.

Acelity/KCI’s NPWT portfolio includes the traditional V.A.C. NPWT platform and the SNaP Therapy system. The AWD platform includes an assortment of dressings for the management of chronic and acute wounds. Lastly, the Specialty Surgical portfolio includes the PREVENA Surgical Incision Management and ABTHERA Open Abdomen Negative Pressure Therapy brands.

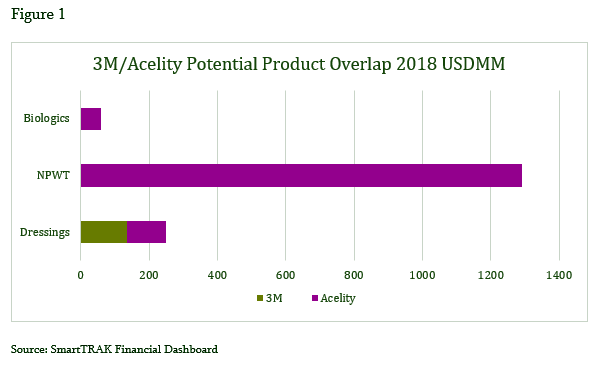

Utilizing data from SmartTRAK’s Financial Dashboard, an analysis was conducted to evaluate the potential product overlap between the 3M and Acelity/KCI product portfolios. As shown in Figure 1, the most significant contribution would come from the acquisition of Acelity/KCI’s NPWT business. In addition, 3M would establish a small footprint in the biologics/collagen dressing market and there would be some overlap in the AWD market.

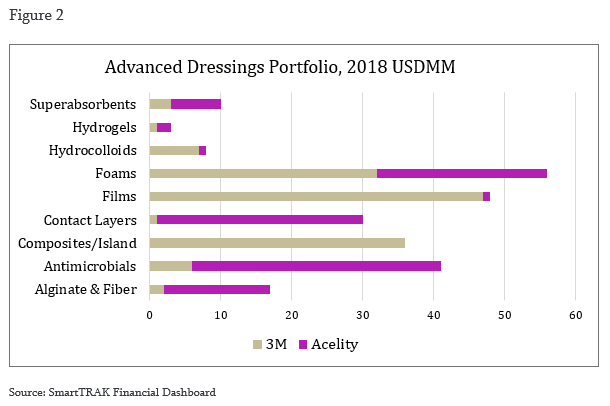

However, a closer look into the dressings’ portfolio reveals that 3M could potentially enhance its product offerings in the following categories: superabsorbents, contact layers, antimicrobials, and alginates (see Figure 2). Furthermore, it is clear that 3M is placing a significant bet on growth in the healthcare sector, with a particular emphasis on advanced wound care, and even more focus on the NPWT market. Considering that Acelity/KCI has a strong footprint in the post-acute market, 3M will also seek to leverage the opportunity to expand its product offering to this setting.

PERFORMANCE

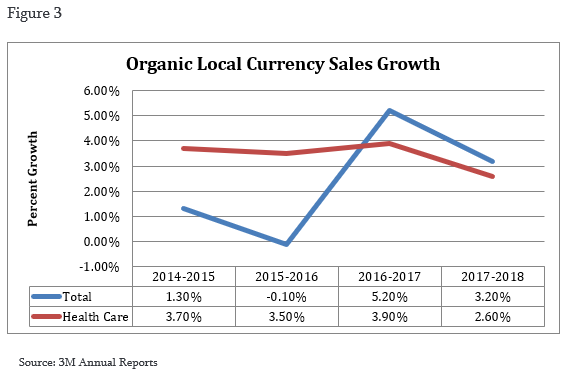

Over the past four years 3M has achieved inconsistent year-over-year (YoY) sales growth as shown in Figure 3. Moreover, 3M updated its 2019 guidance to reflect organic local-currency revenue growth of -1% to 2%. Health Care is expected to contribute 2% to 4% growth for 2019; however, 3M’s other business segments are not expected to contribute significantly to 3M’s 2019 performance. Historically, 3M’s Health Care business has achieved a bit more consistency, averaging around 3.4% sales growth over the past four years. For Q119,3M's Health Care business segment reported revenues of $1.54B, a 0.7% organic local-currency sales increase relative to Q118.

Even as Health Care revenue growth slipped to 2.6% from 2017 to 2018, it is clear that 3M views this division as a stabilizing factor to its overall business. Accordingly, 3M’s CEO, Mike Roman stated in 3M’s press release regarding the Acelity/KCI acquisition that, “Acelity is a recognized leading provider of advanced wound care technologies and solutions and an excellent complement to our Health Care business…This acquisition bolsters our Medical Solutions business and supports our growth strategy to offer comprehensive advanced and surgical wound care solutions to improve outcomes and enhance the patient and provider experience.”

As mentioned previously, approximately 79% of Acelity/KCI’s revenue is derived from NPWT. For FY18, Acelity/KCI’s AWT total revenues were $1.46B, reflecting a local-currency growth rate of 10.0% relative to FY17. NPWT revenues were $1.15B and grew by 4.2% local-currency relative to FY17. Specialty Surgery grew by 49.2% on a revenue base of $92MM and AWD grew by 31% on a base of $128MM local-currency. Thus Acelity/KCI’s FY18 low double-digit revenue growth of 10% was significantly impacted by robust growth in the relatively lower revenue producing segments of Specialty Surgery and AWDs.

Acelity/KCI reported in its FY18 Form S-1 Registration Statement that NPWT local-currency revenue increased relative to the prior year. This was due primarily to an increase in the rental of NPWT systems and the associated increase in sales of consumables used with NPWT. Specialty Surgical revenue for 2018 also increased compared to the prior year. This was reportedly due to increased adoption of the PREVENA Surgical Incision Management System, owing to a growing body of clinical evidence demonstrating a reduction in surgical site complications. Furthermore, Specialty Surgical was boosted by higher sales to European distributors. And lastly, growth in AWDs was positively impacted by higher sales to European distributors and double-digit growth in PROMOGRAN Matrix in the US.

As reported by SmartTRAK, for FY18 the worldwide NPWT market generated $1.71B in revenue and achieved 4.3% YoY growth, with traditional devices having a slight uptick and single-use NPWT systems producing a YoY growth of 28.9%. The AWD market, which accounts for 52.3% of the AWC market and is considered the workhorse of AWC, reached $3.67B in revenue, resulting in a YoY growth of 3.3%.

PAYING FOR GROWTH

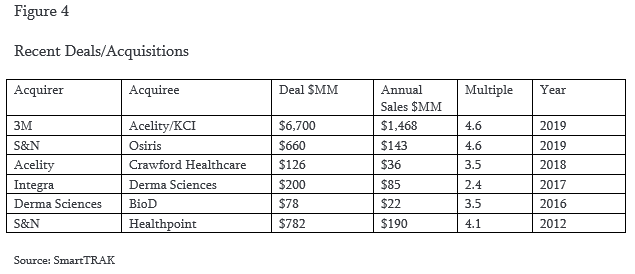

In an effort to generate growth, 3M is allocating a significant portion of its capital to the AWC space. According to SmartTRAK’s Financial Dashboard, the AWC market, which comprises advanced dressings, external devices (primarily NPWT) and biologics, reached $7.01B in 2018 and grew at a compound annual growth rate (CAGR) of 5.2% from 2015 to 2018. As shown in Figure 4, relative to recent deals in the AWC space, the Acelity/KCI acquisition, while consistent with S&N’s acquisition of Osiris, is on the high end of the spectrum. Based on 2018 sales, 3M would pay $4.6 dollars for every $1 dollar of revenue generated by Acelity/KCI.

SYNERGIES

To help soften the purchase price of the deal, 3M anticipates achieving cost synergies of 8% of Acelity/KCI’s revenue within three years of the acquisition. 3M has signaled that part of the cost synergies will come from integration of the sales and marketing functions, in addition to leveraging cost synergies in the supply chain functions by utilizing 3M’s power in supplier sourcing.

RISKS

NPWT is the primary revenue producer for Acelity/KCI. According to SmartTRAK, approximately 65% of the worldwide NPWT revenue is generated in the US. Over the last five years the NPWT business has faced significant reimbursement cuts due to the implementation of The Centers for Medicare and Medicaid Services (CMS) Competitive Bidding Program, which has led to some commoditization of the therapy. As a result of continuing cost pressures, CMS, as well as third party payers, has been pursuing more initiatives to shift health care from a fee-for-service to a value-based payment system. Under a value-based system, there is more pressure on product suppliers to generate clinical and health economic evidence to demonstrate that a product or service can achieve clinical outcomes that are important to payers, providers and patients. As a result, there is the potential that revenue growth could be adversely impacted if the combined companies are unable to generate sufficient evidence to satisfy these stakeholders.

In addition, there are risks that the robust growth rates in Acelity/KCI’s Specialty Surgical and AWD markets will not be sustainable due to increased competition and pricing pressures. Lastly, as in many acquisitions, there is also the risk that management will not be able to effectively integrate the two companies to achieve the projected cost synergies.

Internationally, traditional NPWT continues to be impacted by the cancellation of reimbursement in home care in Germany, the largest NPWT market. Acelity/KCI and other companies are pursing strategies to get reimbursement re-implemented. If unsuccessful, this will continue to dampen growth prospects for traditional NPWT in the largest NPWT market.

FUTURE DIRECTION

From a leadership perspective, it’s important to note that several senior level individuals in 3M’s Medical Solutions business are former KCI employees. With this in mind, 3M is entering this acquisition with a great deal of visibility into the culture and operations of KCI, which may help with the arduous task of integrating the two companies.

Intuitively it makes sense for 3M to pursue growth in the health care segment of the business, in particular AWC. There are many tailwinds in favor of growth in this sector; including an aging population, diabetes and obesity. All of these factors support sustainable future demand for AWC products and services. Furthermore, 3M could use its strong global footprint to better position Acelity/KCI’s product portfolio outside of the US. Likewise, 3M is positioning the Company to leverage Acelity/KCI’s access to the post-acute setting of the market. With the addition of Acelity/KCI’s Prevena Incision management system, 3M could continue to grow its infection prevention business, which has struggled in recent years. Furthermore, 3M is known for its innovation. Their tag line is “3M Science Applied to Life.” This gives Acelity/KCI access to 3M’s large technology portfolio to create more innovative products.

However, there are also headwinds primarily in the form of inadequate reimbursement, pricing pressure and integration concerns. In addition, considering 3M will potentially pay a premium for the acquisition, there will be tremendous pressure to generate growth and achieve cost synergies to meet its return on invested capital target by year five of the deal.

Considering Acelity/KCI’s leadership position in AWC and 3M’s innovative culture and global reach, there appears to be a good chance that this deal will be just what 3M needs to reach and sustain mid-single digit revenue growth.

To find out more about SmartTRAK's analysis and coverage of the wound care industry, please click the button below.