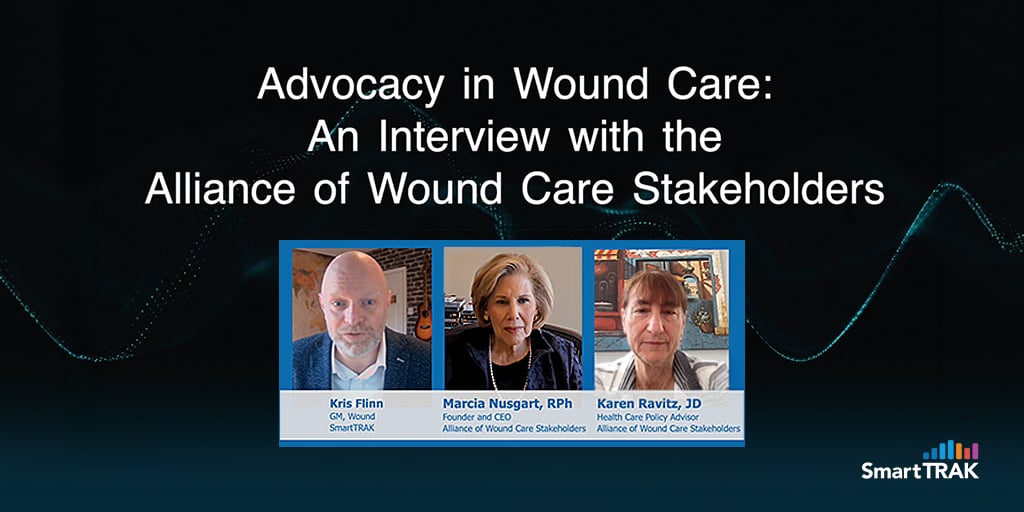

SmartTRAK interviews two leaders from the Alliance of Wound Care Stakeholders to discuss its aim to be the unified voice for the wound care community, ensuring quality care for all patients with chronic wounds.

4 min read

Advocacy in Wound Care: An Interview with the Alliance of Wound Care Stakeholders

By Kris Flinn on 3/6/26 1:26 PM

3 min read

Attacking Bioburden and Infection: Four Advanced Dressing Companies to Watch in 2026

By Lennart Stadler on 2/20/26 2:02 PM

SmartTRAK highlights four wound companies to watch in 2026 with new-generation antimicrobial alternatives

The way clinicians are handling wound infections is changing. For several decades, silver has been the go-to treatment for infected wounds because it effectively kills a wide range of bacteria, and currently represents around 70% to 80% of the antimicrobial dressings market. Other technologies have been around for a long time, the most common being PHMB, Iodine and Chlorhexidine. SmartTRAK has identified trends in the Advanced Dressing Market that are driving demand for new and improved dressings to address the following concerns about existing treatments:- Bacteria are becoming resistant to silver, making it less effective.

- Several existing antimicrobial technologies may induce cytotoxic effects.

- Silver dressings are commoditized, and the market is hungry for novel and innovative alternatives.

- Stricter medical rules (antimicrobial stewardship) now require clinicians to be more careful about how they use germ-killing treatments, as there has been a widespread habit of using these dressings on wounds that do not actually need them.

In the complete downloadable article, SmartTRAK highlights in detail four companies to watch in 2026 with advanced dressings that offer new approaches to attacking bioburden and infection while limiting antimicrobial resistance. They are:

-

Convatec: Seeing Great Potential with ConvaNiox

Convatecis the global leader in the antimicrobial dressings market with its Aquacel Ag range. It is evident that they are convinced that ConvaNiox will be their next big brand in wound care ... (read more) -

Polaroid Therapeutics

Polaroid Therapeutics (PTx) is a Swiss-based biotech start-up developing innovative products and solutions using its proprietary novel antimicrobial technology ... (read more)

3 min read

Will the New Skin Substitute Reimbursement Policies Create an Access to Care Crisis?

By Elizabeth Anderson on 2/10/26 9:30 AM

SmartTRAK reviews how the changes to skin substitute reimbursement reforms may impact each site of service and what it means for patients, providers and manufacturers.

In response to the meteoric rise in spending, the Centers for Medicare and Medicaid Services (CMS) enacted payment reforms, establishing a standardized reimbursement rate of ~$127/sq cm for skin substitutes across physician offices, mobile and hospital outpatient departments (HOPD). SmartTRAK believes that these reimbursement reforms could trigger an access-to-care crisis for some patients in the wound care sector. This could result in care being shifted to the high-cost, inpatient operating room (OR) for the most critical patients or lead to an increased number of amputations. The system may realize short-term savings on grafts, but the systemic result could be a spike in the total cost of care for some patients and, for others, no advanced care at all.

Since 2021, the US Advanced Wound Care Market has undergone a transformation defined by a "site-of-service" migration away from the hospital outpatient department (HOPD). As CMS implemented restrictive bundled-payment models in HOPDs in 2014 that capped reimbursement in “high” and “low” buckets, care began to shift toward... (read more)

-

The Physician Office (PFS) - In the physician office (PO), the $127/sq cm rate could result in a "reverse triage" effect, where minor or complex wounds become ...(read more)

2 min read

The Future of US Advanced Wound Care Devices in 2026 and Beyond

By Jay Merkel on 2/3/26 9:30 AM

SmartTRAK looks at what’s shaping existing devices and what’s new in the US External Wound Care Devices Market.

In the market for advanced wound care, negative pressure wound therapy (NPWT) currently dominates the WW External Devices segment. In this article, SmartTRAK examines factors shaping the US External Devices Market in 2026 and discusses the future of NPWT, the growth of oxygen-based therapies and the imminent arrival of new external devices, including cold plasma therapy and concurrent optical magnetic stimulation.

Among the topics discussed in detail in the complete article are:

-

NPWT Continues to Dominate - Because traditional NPWT currently has a high penetration rate in the hospital setting, SmartTRAK expects the growth rate for NPWT in the US to be ... (read more)

-

Oxygen Therapy Awaits CMS - SmartTRAK projects sales of topical oxygen therapy (TOT) products to reach ... (read more)

-

Challenges in Skin Substitutes Open the Door for Novel Therapies - Although wound care spending has been dominated by the use of skin substitutes over the last few years, this article highlights several companies that currently offer these technologies in Europe and are poised to bring other novel wound treatment devices to the US market, including: Coldplasmatech GmbH, Terraplasma, Plasmacure, Adtec, Piomic ... (read more)

Among all these new wound-healing devices, SmartTRAK anticipates that the future of advanced wound care devices will continue to grow in both size and complexity.

Want to learn more about the factors shaping the US Advanced Wound Care Devices Market in 2026 and beyond? Click the button below to download and read the complete article written by Jay Merkel, SmartTRAK Senior Analyst.